Moving money between the India Post Payments Bank (IPPB) and Post Office Savings Bank (POSB) accounts has become easy and quick. This detailed guide How to Transfer Money from POSB to IPPB will take you through the procedure thus guaranteeing effective financial management.

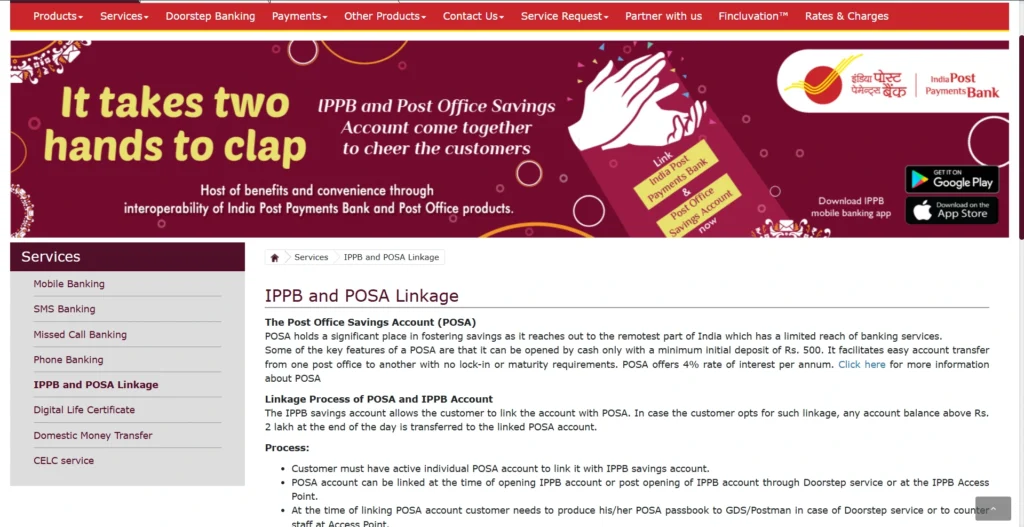

Step 1: Link Your POSB Account with IPPB

To initiate fund transfers, you must first link your POSB account with your IPPB account. Here’s how:

Verify That Both Accounts Are Live:

Check the functionality of your IPPB and POSB accounts.

Go to the Nearest Post Office or Request Doorstep Service.

- In the Post Office: Bring your POSB passbook to the counter personnel.

- Doorstep Service: The Gramin Dak Sevak (GDS) or Postman visiting your location will be presented with your POSB passbook.

Verify:

You will get an SMS message on your registered mobile number after the accounts have been effectively connected.

Step 2: Transfer Funds Using the IPPB Mobile Banking App

After linking your accounts, you can easily transfer funds using the IPPB Mobile Banking App. Follow these steps:

- Log In:

- Open the IPPB Mobile Banking App and log in with your credentials.

- Initiate the Transfer:

- Select the “Fund Transfer” option.

- Choose “Transfer to Self Account.”

- Enter the amount you wish to transfer.

- Confirm the Transaction:

- Review the transfer details and confirm to complete the transaction.

Pro Tip: Ensure that your mobile number is registered with both IPPB and POSB for a smoother experience.

Step 3: Utilize the Sweep-In and Sweep-Out Facility

You can automate the administration of your funds between your IPPB and POSB accounts using IPPB’s one-of-a-kind Sweep-In and Sweep-Out feature:

- Should your IPPB account balance at the end of the day surpass ₹2 lakh, the surplus is instantly transferred to your associated POSB account.

- The IPPB Mobile Banking App lets you transfer money.

- While maintaining permissible balance limits, this feature guarantees that your funds are efficiently managed.

Benefits of Linking POSB and IPPB Accounts

Linking your POSB and IPPB accounts comes with several advantages:

Seamless Fund Transfers:

- Easily shift money across your accounts with the IPPB Mobile Banking App.

- Funds sent to your POSB account generate more interest, therefore maximizing your savings.

- With the Sweep-In and Sweep-Out feature, you can efficiently manage your cash and make sure it remain within the allotted limitations.

Conclusion

These instructions will help you to quickly Transfer money from your POSB account to your IPPB account. You may streamline your transactions and make the most of your money by connecting these accounts. IPPB’s integrated services make the procedure safe and quick whether you’re maintaining surplus balances or moving money for everyday usage.