An important change to the pension system for government workers has been announced with the Unified Pension Scheme (UPS) announcement, according to the latest gazette. Designed to solve issues about financial security upon retirement, the program provides a balanced and guaranteed solution by combining features of the previous pension system with the National Pension System (NPS).

Here is a comprehensive summary of the most recent UPS alert and how it affects government staff.

Key Features of the UPS Notification

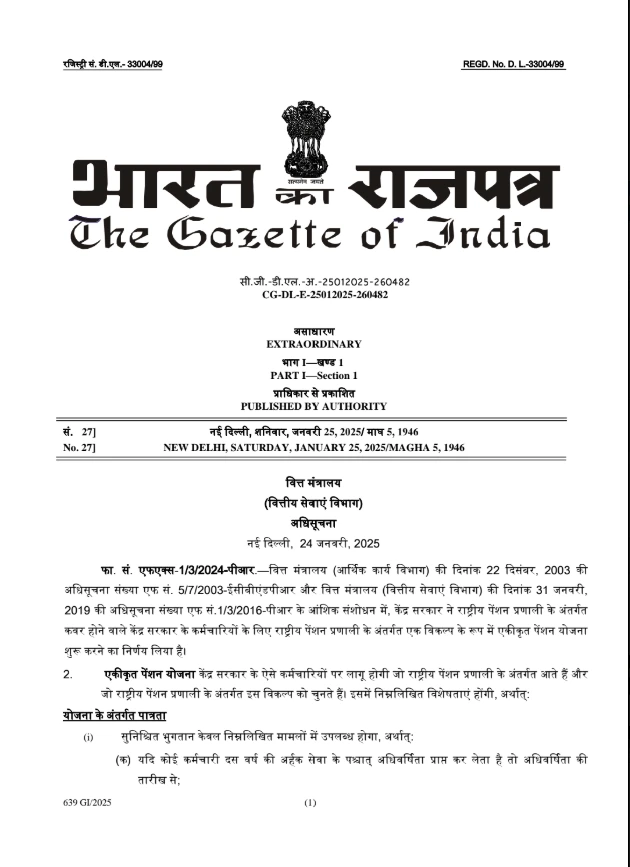

Eligibility Criteria

- All central government workers who began service on or after January 1, 2004 and are now covered by the NPS are covered by the UPS. These workers now have the choice to choose the UPS to get a greater pension.

Guaranteed Pension Payout

- The guarantee of 50% of the last received wage as a pension marks the main focus of the announcement. This guaranteed payback ensures financial security for retirees by bringing back the dependability of the previous pension system.

Government Contributions

- The plan keeps the NPS government contribution element wherein 14% of the base salary and dearness allowance (DA) is contributed to the pension account of the employee. This guarantees workers have a strong retirement corpus.

Voluntary Contributions

- Employees of the UPS are free to make voluntary contributions to their pension plans. This freedom helps workers improve their financial situation when they retire.

Seamless Transition

- Clear policies described in the gazette announcement will direct staff members intending to migrate to the Unified Pension Scheme from the NPS.

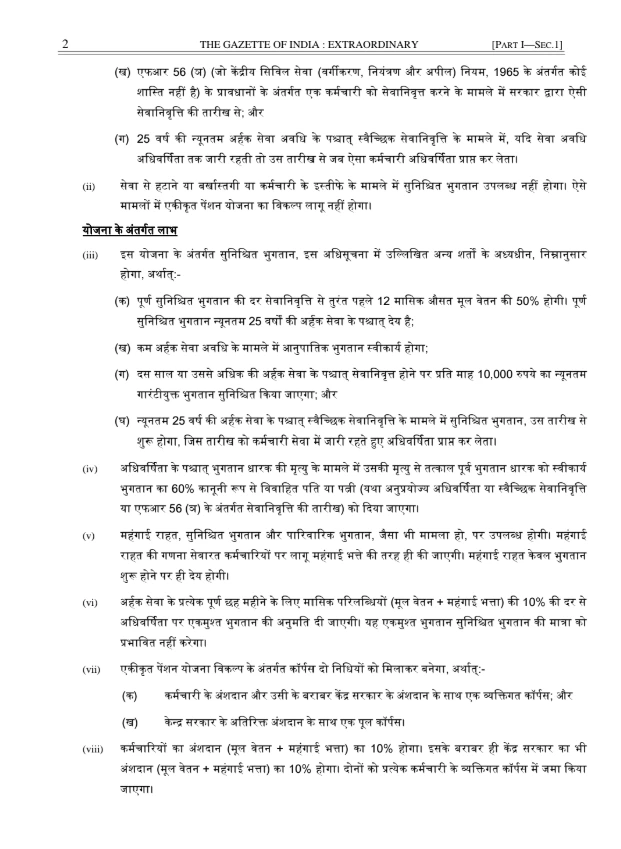

Benefits of the Unified Pension Scheme

Assured Retirement Income

- The assured pension guarantees pensioners a consistent income, therefore removing the uncertainty related to market-dependent returns under the NPS.

Employee-Centric Approach

- The program shows a proactive attitude by attending to the long-standing needs of workers for a consistent and safe retirement plan.

Flexibility with Voluntary Savings

- Using voluntary contributions, employees may create a bigger retirement corpus, thereby increasing their financial future control.

Alignment with Old Pension Benefits

- The UPS closes the NPS gap by providing elements akin to the previous pension system, therefore giving workers much-needed financial certainty.

Implementation Guidelines

The notification outlines the necessary procedures for implementation:

- Employees must submit their option to transition to the Unified Pension Scheme within the stipulated timeline.

- Contributions made under the NPS will be seamlessly integrated into the new scheme.

- The government will continue contributing to the retirement corpus, ensuring a smooth shift without financial disruptions.

Why the UPS Notification Is Important

The Unified Pension Scheme tackles important issues NPS members experience, including financial uncertainty and lack of certain returns. It finds a compromise between employee welfare and government financial restraint.

The alert guarantees a clear and methodical procedure for staff members to choose the strategy. Those working in fields where post-retirement security is a major issue should especially find this development significant.

Conclusions

A gradual step in pension changes, the Unified Pension Scheme (UPS) notice guarantees government staff financial security. Offering guaranteed payments, adaptability, and government contributions, the plan offers a complete retirement option.

Workers are advised to carefully go over the notice and assess the advantages of switching to UPS. This program guarantees a decent and stress-free post-retirement life for central government workers by tackling long-standing problems and improving retirement security.