Atal Pension Yojana Chart – The Atal Pension Yojana (APY) is an Indian government-backed pension plan that helps workers in the unorganised sector ensure a steady income after they leave.

The plan started in 2015 and guarantees a minimum monthly income of between ₹1,000 and ₹5,000, based on how much the member puts in and when they start participating.

Atal Pension Yojana Eligibility and Enrollment

Indian nationals 18 to 40 years old can join Atal Pension Yojana Chart. To enrol, a savings account must be currently open. Payments are automatically taken out monthly, quarterly, or every six months, making saving easy.

People must start contributing at least 20 years before they can start getting pensions at age 60. This means that people must start contributing by four decades old.

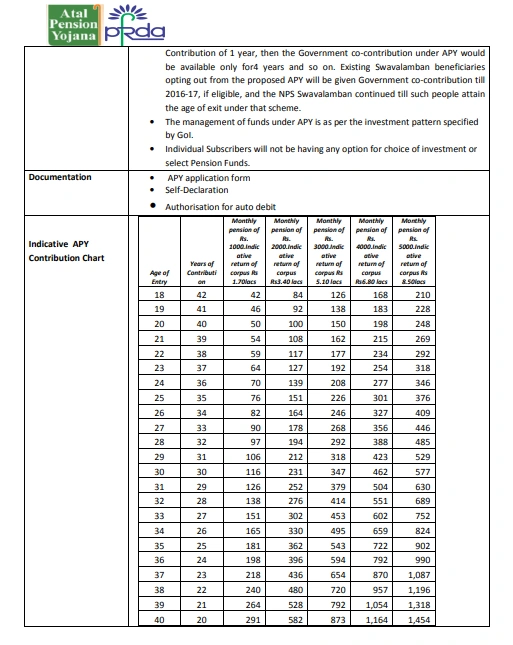

Atal Pension Yojana Scheme Chat Contribution Details

Atal Pension Yojana Scheme Chat: A person’s desired pension and starting age determine their required contribution amount. An example of this would be a monthly contribution of ₹42 from a subscriber who wants to start saving for a ₹1,000 pension at the age of 18.

A 40-year-old, on the other hand, would have to put away ₹291 every month to get the same income. You may get the same pension benefit with a smaller contribution if you start sooner.

| Entry Age | ₹1,000 Pension | ₹2,000 Pension | ₹3,000 Pension | ₹4,000 Pension | ₹5,000 Pension |

| 18 | ₹42 | ₹84 | ₹126 | ₹168 | ₹210 |

| 25 | ₹76 | ₹151 | ₹226 | ₹301 | ₹376 |

| 30 | ₹116 | ₹231 | ₹347 | ₹462 | ₹577 |

| 35 | ₹181 | ₹362 | ₹543 | ₹722 | ₹902 |

| 40 | ₹291 | ₹582 | ₹873 | ₹1,164 | ₹1,454 |

Atal Pension Yojana Benefits and Features

- Guaranteed Pension: Members may rest easy knowing they will receive a set monthly pension once they reach the age of 60.

- Death Benefits for Spouses: If the subscriber were to pass away, their spouse would continue to receive a pension equal to their husband’s.

- Designee Provision: The accumulated pension corpus is returned to the designee following the demise of both the subscriber and the spouse, providing the next of kin with the benefits.

- Flexible Contributions: Subscribers can modify their pension amount, which results in commensurate adjustments to their contributions. This adaptability enables individuals to modify their savings according to their financial circumstances.

Tax Benefits

Individuals who contribute to the APY can get tax breaks similar to those offered by the National Pension System (NPS). This is another reason for people to use this plan to save for retirement.

Recent Updates

In February 2025, the APY’s structured pension offerings were already benefiting millions of subscribers, and it continues to gain momentum. To guarantee that a greater number of citizens can have a secure post-retirement existence, the government conducts regular evaluations and revisions of the scheme to improve its effectiveness and reach.

Potential users should use the APY tool on the National Pension System Trust’s website to get a better idea of the plan and do their figures.

To obtain a comprehensive comprehension and customised calculations, prospective subscribers are advised to utilise the Atal Pension Yojana Scheme Chat calculator that is accessible on the National Pension System Trust’s official website.

Conclusion

As a strong program, the Atal Pension Yojana encourages people who don’t work for a company to save money, which will protect their finances in their golden years.