The India Post Payments Bank (IPPB) has unveiled a new reward scheme designed to boost end users’ profits and motivation in the constantly changing financial services industry.

The IPPB End Users Revised Incentive Structure is thoroughly explained on this page, which also offers extensive details on some related topics.

IPPB incentive structure for GDS 2024, IPPB agent commission chart, IPPB incentive structure for end users updated incentive structure PDF, and IPPB incentive structure are the keywords we will be concentrating on.

Let Us Understand the IPPB Incentive Structure

Overview of IPPB Incentive Structure

The purpose of the IPPB Incentive Structure is to recognize and honour the contributions made by agents, Gramin Dak Sevaks (GDS), and other end users to the bank’s outreach and service provision. An official PDF document that may be downloaded provides details on performance-based incentives included in the redesigned structure.

Incentive Structure Highlights

- Performance-Based Rewards: This system makes sure that those who perform well in their positions receive appropriate compensation by linking the incentives to the GDS and agents’ performance indicators.

- Tiered Commission System: Different commission rates apply depending on the volume of transactions and the kinds of services offered.

- Extra Bonuses: If certain goals are met within a predetermined time, extra bonuses are given.

Accessing the IPPB Incentive Structure PDF

The official IPPB website provides access to the comprehensive IPPB Incentive Structure PDF. This publication offers a thorough analysis of the incentive programs, which include the IPPB Incentive for GDS 2024 and the IPPB Agent Commission Chart.

Revised IPPB incentive Structure for AEPS and CELC

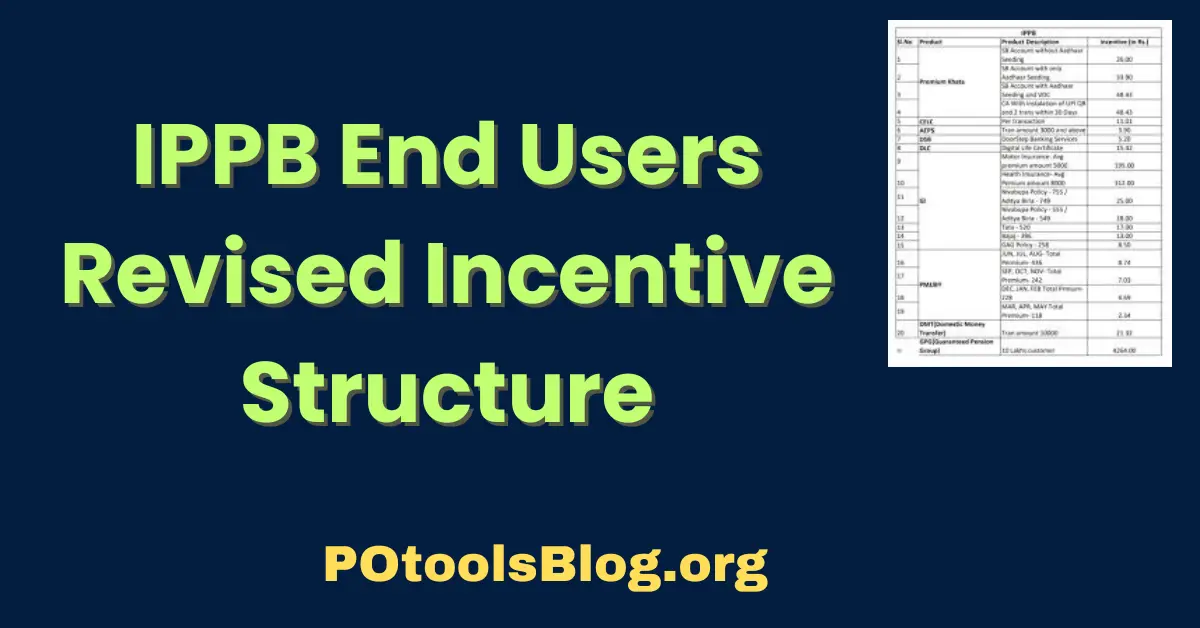

| Products/Services | Rate per Unit | Incentive to End User (L0) |

| Aadhaar-enabled Payment System | Free(*0.50% of transaction amount subject to max. ₹15/- per transaction. No income for transactions of less than ₹10/-) | ₹ 3.90* |

| CELC- Aadhaar-Mobile Update Service | ₹ 50 | ₹ 11 |

| CELC- Child Aadhaar Enrolment | Free | ₹ 10 |

Revised IPPB incentive Structure for Life Insurance and Health Insurance

| Products/Services | Rate per Unit | Incentive to End User (L0) |

| Digital Life Certificate | ₹ 70 | ₹ 15.40 |

| Life Insurance – Term | ₹ 10,000(Ex. Premium) | ₹ 1040 |

| Life Insurance – Annuity | ₹ 2,00,000(Ex. Premium) | ₹ 2080 |

| Health Insurance | ₹ 8,000(Ex. Premium) | ₹ 264 |

Revised IPPB incentive Structure for General Insurance

| Products/Services | Rate per Unit | Incentive to End User (L0) |

| General Insurance – Motor | ₹ 5,000(Ex. Premium) | ₹ 165 |

| Group Accident Guard (GAG) – TAGIC | ₹ 520(Ex. Premium) | ₹ 17 |

| Group Personal Accident (GPA) – BAGIC | ₹ 699(Ex. Premium) | ₹ 23 |

| Group Personal Accident (GPA) – NIVA | ₹ 755(Ex. Premium) | ₹ 25 |

| Group Personal Accident (GPA) – ABHI | ₹ 749(Ex. Premium) | ₹ 25 |

| Group Personal Accident (GPA) – STAR | ₹ 799(Ex. Premium) | ₹ 26 |

| Group Hospi Cash + Cancer Care + Health Service | ₹ 1094(Ex. Premium) | ₹ 36 |

| International Money Transfer Services (RIA MONEY – Inward remittance) | ₹ 20,000(Avg. Amount) | ₹ 52 |

Revised IPPB incentive Structure for PMJJBY

| Products/Services | Rate per Unit | Incentive to End User (L0) |

| Life Insurance – PMJJBY | ₹ 436,₹ 343,₹ 228 &₹ 114 | ₹ 10.60,₹ 8.60,₹ 5.70, &₹ 2.80 |

Revised IPPB incentive Structure for IPPB Account Opening

| Products/Services | Rate per Unit | Incentive to End User (L0) |

| Premium Account (without Aadhaar seeding) | ₹ 149 + GST (= ₹ 176) | ₹ 26.00 |

| Premium Account (with Aadhaar seeding) | ₹ 149 + GST (= ₹ 176) | ₹ 33.90 |

| Premium Account (with Aadhaar seeding & Virtual Debit Card) | ₹ 176 + 25 (VDC) (= ₹ 201) | ₹ 48.30 |

Revised IPPB incentive Structure for IPPB Loan

| Products/Services | Rate per Unit | Incentive to End User (L0) |

| Average loan amount: ₹ 7 lakh for home loans and loans secured by property | – | ₹ 1092 – ₹ 1547 |

| Personal Loan: ₹ 2 Lakh is the average loan amount. | – | ₹ 364 – ₹ 1040 |

| Tractor Loan (Average Loan Amount – ₹ 5 Lakh) | – | ₹ 1300 |

| ₹ 3 Lakh is the average loan amount for a two- or four-wheeler vehicle. | – | ₹ 546 – ₹ 780 |

| Gold Loan: ₹ 0.80 Lakh is the average loan amount. | – | ₹ 104 – ₹ 167 |

Detailed Breakdown of IPPB Incentives for GDS

Commission Rates and Incentives

Certain commission rates for certain financial services are part of the IPPB incentive framework for GDS 2024. Opening an account, making deposits, getting withdrawals, transferring money, and more are included in these services. To motivate GDS to actively contribute to extending IPPB’s reach, commission rates have been established.

Account Opening Incentives

- Savings Account: A fixed commission is provided for each savings account opened.

- Recurring Deposit Account: Additional incentives for opening recurring deposit accounts.

Transaction-Based Incentives

- Deposits and Withdrawals: Variable commissions based on the transaction amount.

- Money Transfers: Higher commissions for facilitating money transfers.

Performance Bonuses

Performance bonuses have been provided by IPPB to further incentivize GDS. These incentives are given out when a target is met, such as completing a specific number of transactions in a given month or quarter.

IPPB Agent Commission Chart

Understanding the commission rates that apply to various services is made easier with the help of the IPPB Agent Commission Chart. A clear and simple summary of the prospective profits for agents is given in this figure, which is included in the incentive structure PDF.

The Commission Chart’s Principal Elements

- Service Types: The chart divides services into many categories, including money transfers, account openings, withdrawals, and deposits.

- Commission Rates: Comprehensive commission rates broken down by service type.

- Performance Metrics: Standards for obtaining extra incentives and bonuses.

Maximizing Earnings with the Commission Chart

Agents might make use of the commission chart to plan their actions and increase their profits. Achieving performance bonuses and concentrating on high-commission services can help agents greatly increase their revenue.

Advantages of the Revised IPPB Incentive Structure

Many advantages are provided to GDS and agents by the updated incentive system, which improves IPPB’s overall service provision.

Increased Drive

For GDS and agents, performance-based bonuses and incentives are a major source of motivation. Improved customer service and higher productivity are the results of this drive for IPPB clients.

A Rise in Profits

Agents who work hard and perform well are rewarded with higher commissions and unique bonuses from GDS. Increased work satisfaction and commitment to IPPB may result from this pay boost.

Enhanced Provision of Services

IPPB may anticipate enhanced service delivery with highly motivated and compensated GDS and agents. The final consumers gain from this enhancement as they get timely and effective financial services.

How to Download the IPPB Incentive Structure PDF

It is simple to obtain the IPPB Incentive Structure PDF. The document may be downloaded by following these steps:

- Go to the IPPB’s official website: Go to the official website of the IPPB.

- Look for Incentive Framework: To locate the incentive structure document, use the search box.

- Get the PDF here: To save the PDF to your device, click the download link.

Conclusion

The thorough and well-thought-out IPPB End Users Revised Incentive Structure is intended to increase GDS and agents’ motivation and revenues.

IPPB seeks to enhance customer happiness and service delivery by providing tiered commission rates, performance-based incentives, and unique bonuses.

Visit the official IPPB website to get the IPPB Incentive Structure PDF, which contains more specific information.

FAQs

From where can I obtain the PDF of the IPPB Incentive Structure?

The official IPPB website offers a PDF of the incentive structure. To download the incentive structure paper to your device, just go to the website, use the search box to locate it, and then click the download link.

Inside the updated IPPB incentive system, what kinds of incentives are available for GDS?

The updated IPPB incentive plan for GDS comprises bonuses for meeting certain goals during a predetermined period, tiered commission rates for different financial services such as account creation, deposits, withdrawals, and money transfers, and performance-based awards.

How does the IPPB Agent Commission Chart help agents maximize their earnings?

Services are categorized and precise commission rates for each category are provided by the IPPB Agent Commission Chart. Agents should strategically arrange their operations to optimize their revenue by concentrating on high-commission services and striving for performance bonuses.