OPS vs NPS vs UPS: On April 1, 2025, the Unified Pension Scheme (UPS) will replace the Old Pension Scheme (OPS) and the New Pension System (NPS) in India, providing a new pension option for central government workers.

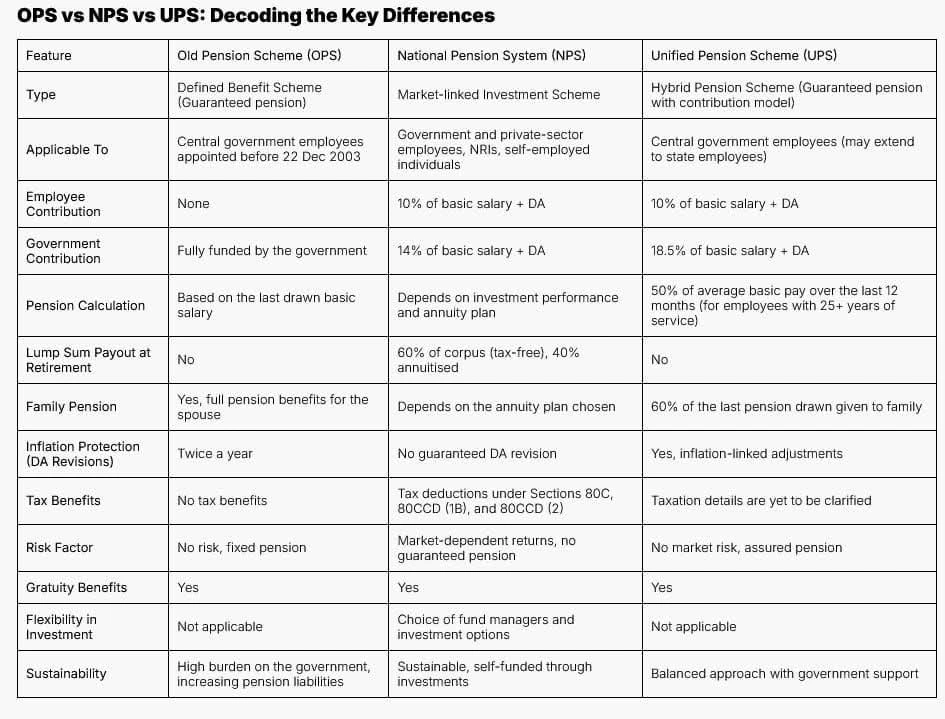

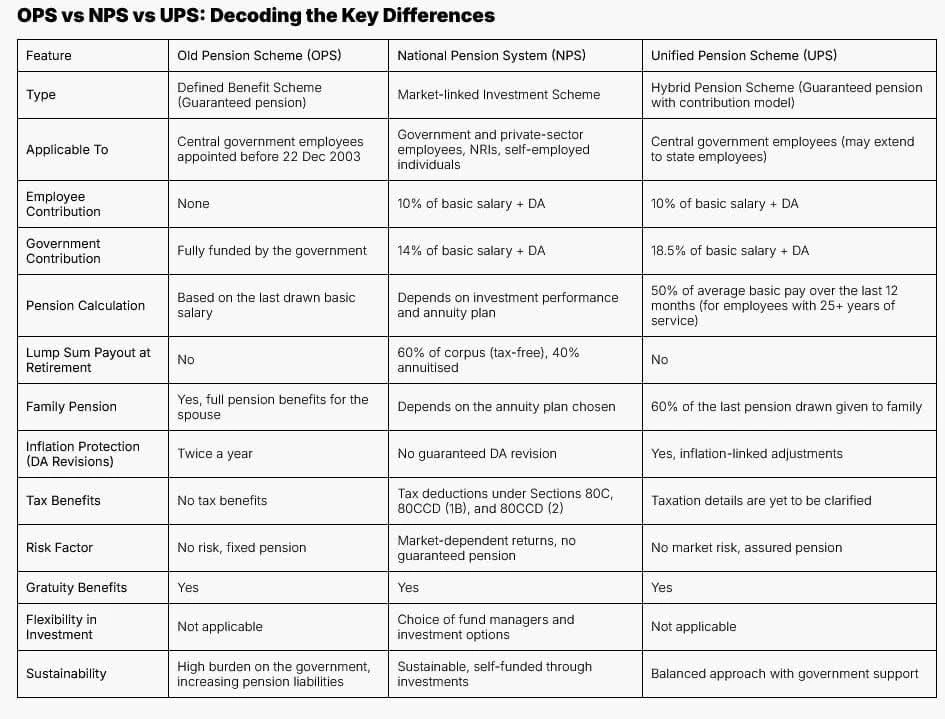

| Feature | OPS (Old Pension Scheme) | NPS (New Pension Scheme) | UPS (Unfunded Pension Scheme) |

| Type of Scheme | Defined Benefit Pension | Defined Contribution Pension | No dedicated funding source |

| Contribution | No employee contribution | Mandatory contribution (10% by employee, 14% by employer) | No specific contribution |

| Pension Amount | Fixed (based on last drawn salary) | Market-linked, varies based on returns | Depends on government decision |

| Fund Management | Fully government-funded | Managed by PFRDA with multiple investment options | No structured fund management |

| Withdrawal Option | No lump sum withdrawal | 60% lump sum withdrawal, 40% annuity | No pre-defined withdrawal rules |

| Tax Benefits | Not taxable | Partial tax benefits | No structured tax benefits |

| Security | Guaranteed pension for life | Market-dependent returns | Depends on government funding |

| Applicability | Government employees (before 2004) | Employees who joined after 2004 | Certain non-pensionable government employees |

Unified Pension Scheme (UPS) Key Features:

Employees who have worked for the company for at least 25 years are eligible for a guaranteed pension that is half of their average basic wage for the twelve months before retirement. A minimum pension of ₹10,000 per month is guaranteed to anyone with more than 10 years of service.

In the case of a pensioner’s death, their family will be entitled to 60% of the final pension payment. News from The Financial Express

Switching to the UPS is an option for current NPS members, giving workers more flexibility to choose a pension plan that works for them in retirement.

Points of Comparison:

Funded totally by the government and not by employees, the Old Pension Scheme (OPS) provides a defined benefit pension based on the final wage taken.

Workers and businesses put away 10% and 14% of their income, respectively, into the New Pension System (NPS), which is based on a defined contribution model and uses market performance to determine investment returns.

To alleviate worries about the market volatility that comes with NPS and to offer a steady and predictable income after retirement, the Unified Pension Scheme (UPS) combines elements of both the Old Pension Scheme (OPS) and the National Pension System (NPS).

Challenges Facing Federal Employees:

The implementation of UPS is expected to have a significant impact on approximately 23 lakh central government employees, providing them with a new retirement planning option that optimally balances flexibility with guaranteed returns.

Employees are asked to weigh their alternatives in light of their years of service, retirement aspirations, and risk tolerance as the rollout date draws near. Making informed decisions regarding the transition between pension schemes can be facilitated by consulting with financial advisors or attending informational sessions offered by the government.